How to raise your win rate by 20%

All executives want to increase their win rate. If you could raise your company’s overall win rate by 20%, the payoff in additional revenue, earnings, and shareholder value could be huge. Company revenues would increase, earnings would increase by the marginal profit rate on the new revenue, and shareholder value would increase proportionally to your increase in earnings.

All executives want to increase their win rate. If you could raise your company’s overall win rate by 20%, the payoff in additional revenue, earnings, and shareholder value could be huge. Company revenues would increase, earnings would increase by the marginal profit rate on the new revenue, and shareholder value would increase proportionally to your increase in earnings.

But, knowing which investments to make and predicting the payoff is the challenge. Here’s how to choose your investments and predict the resulting increase in win rates.

First, let me make sure everyone understands that we are talking about the investment you make to improve your company’s overall win rate. This is the average win rate on all proposals your company submits, not your win rate on a specific proposal. (We use a different model to predict the outcome for individual bids.)

7-Factor Model

To predict increases in overall company win rates, we use a 7-Factor model. Since we are not aware of any other models that do this, we’ve called it the Lohfeld 7-Factor Company Win Rate Model.

While the model predicts overall company win rates, more importantly, it also predicts how a company’s win rate is affected by changing investments in these 7 factors—and that’s what we’re after. If we can predict how the win rate is affected by changes in the 7-Factor score, then we can make investments with confidence, knowing that we can predict the resulting win-rate increase.

The 7-Factor score is based on:

1. People: The skills and experience of the people involved in creating proposals.

2. Business acquisition process: Business acquisition maturity covering the five stages of business acquisition life cycle.

3. Tools: Proposal infrastructure and personal and productivity tools.

4. Management decision-making: Qualification and bid decisions.

5. Solution competitiveness: Competitive solution with good features and customer benefits.

6. Proposal quality: Quality proposals that are always compliant, responsive, and compelling.

7. Winning culture: Winning culture with good work/life balance.

We assess each of the 7 factors using four yes/no questions. Each yes answer contributes one point to a company’s overall score. A perfect assessment scores 28 points and, by the way, we have never seen a company earn all 28 points. Each question takes 15 seconds to read and answer. With 7 factors and 28 questions, it takes 7 minutes to complete the assessment to see how your company rates in each factor.

Here’s an example of how the assessment works. The first assessment factor is People. Skilled people write better proposals than those who are not so good at it. To assess the skill and experience of the people working capture and proposals, we ask four questions. The answers are based on the skill and experience of your internal staff as well as consultants you use.

RELATED MATERIAL

To take the full questionnaire and receive a presentation that explains the 7-Factor Model, click here.

The first question is, “Does your capture and proposal core team include your best and brightest professionals, and do they know how to create winning proposals?” You get one point if your answer is yes and zero points if the answer is no. You get a second point if you answer yesto the question, “Are your Proposal Managers always well matched to their assignments and do they always have the right leadership qualities and experience level for the assignment,” (or if you don’t have the right person available from your in-house team, you go outside your company for proposal management support). You get a third point if you have a career development plan for your proposal professionals, which includes professional development and skills training. You get a fourth point if you can readily add additional proposal resources to augment your team to accommodate fluctuating workloads.

Answer each of these questions with a yes or no. Each yes gets one point, and each no gets zero points. If your answer is somewhere between yes and no, give yourself a half point. Once you complete your 7-Factor Assessment score, you’re ready to begin looking at investments.

Selecting investments to raise your win rates

Your strategy is to make company investments that will raise your 7-Factor Assessment score. The higher your assessment score, the higher your overall win rate will be.

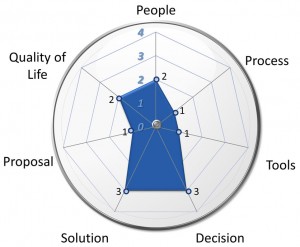

To see which factors to improve, plot your scores on our Lohfeld 7-Axis Diagram. The Lohfeld 7-Axis Diagram provides a graphical representation of your assessment scores and shows at a glance those factors that need to be increased via investments. Invest in factors with the lowest scores first since generally they have a greater variety of investments that will raise your score. Make the least costly investments first with the objective of investing the least amount of money to get the highest increase in scores.

To see which factors to improve, plot your scores on our Lohfeld 7-Axis Diagram. The Lohfeld 7-Axis Diagram provides a graphical representation of your assessment scores and shows at a glance those factors that need to be increased via investments. Invest in factors with the lowest scores first since generally they have a greater variety of investments that will raise your score. Make the least costly investments first with the objective of investing the least amount of money to get the highest increase in scores.

Let’s assume that a company wants to make investments to raise the People factor. If the scorers went back to their assessment scores, they might find that one of the contributing factors to the low score was that they didn’t have a professional development training program for their capture and proposal staff.

Since the company can implement such a program inexpensively, this should be their first planned investment. Similarly, they would use their assessment scores in the Process and Tools factors to guide them in selecting appropriate investments to raise their scores for these factors.

Using this approach, the company would build a plan of investments to raise its 7-Factor scores systematically and thereby raise its win rates.

Calibrating the model

To measure how much a company’s win rate increases with increases in 7-Factor scores, we worked with the Association of Proposal Management Professionals (APMP) and had 45 proposal managers assess their companies and correlate their assessment scores with win rates. We did this exercise at the APMP Nor’easters Chapter Fall Symposium 2011 and the APMP Southern Proposal Accents Conference (SPAC). Our survey results solidly confirm that companies with higher 7-Factor Assessment scores had higher win rates.

From the APMP data, we found that government contractors with a 20% increase in their 7-Factor Assessment score on average yielded a 20% increase in their win rate. Clearly, government contactors should strive to increase their 7-Factor scores since the modest investment can produce large payoffs in new business revenue.

We also found that on average companies in the government market had 17% higher 7-Factor scores and 28% higher win rates than companies in the commercial space.

Perhaps government-market win rates track more closely to the quality of capture and proposal work, whereas commercial proposals are more broadly influenced by brand marketing.

Predicting Your Return on Investment

As a general rule, your win rate percentage will increase point for point with the increase in your 7-Factor score. This rule applies to companies that develop enough proposals each year that they have a good proposal team, some established processes, and are doing reasonably well winning their share of bids.

Your company needs to have enough proposal volume to produce an economic payoff for making the investments. Your company also needs to have a reasonable win rate established as a starting point.

If you have a very low win rate, there may be other serious problems that need to be fixed before you fine-tune your business-acquisition efforts.

Here’s what a typical company might expect. (Stick with me because there is some math here, but I promise nothing more complicated than multiplication and division.)

A typical government contractor graduating from the small business program might have $40M a year in revenue, a 30% win rate, and a 16 for its 7-Factor score.

Let’s assume the company must generate $20M in replacement revenue just to stay even and wants to grow revenue by 20% ($8M) next year. To do this, the company must have $28M in new revenue next year.

If awarded contracts have a nominal 5-year period of performance, then the company has to win $140M in new business. If its win rate is 30%, and the win rate doesn’t drop after graduation, then the company has to bid $466M to produce $28M in new revenue next year.

Now assume that the company selects investments that will raise its 7-Factor score by 20% with the expectation that this will result in a 20% increase in its win rate. Increasing the win rate by 20% means the win rate will go from 30% to 36%. This will produce additional revenue equal to 6% of all bids the company makes.

In this example, 6% of $466M is an additional $30M in revenue. If the marginal profit rate is 5%, the investments would drop $1.5M to the company’s bottom line.

From a shareholder perspective, the additional $30M in new business spread across a 5-year period of performance would bump up revenue by $6M next year and could increase shareholder value by the same amount, assuming shares are valued at 1 times revenue.

Now compute the ROI. Assuming our example company needs to make $200K in investments to raise the 7-Factor score by 20%, and the revenue increase produced an additional $1.5M to the bottom line, then the ROI ratio would be 7.5 to 1. I believe this is called a no brainer.

Make the investments and move on to enjoy your new-found prosperity.

About the Author

Bob Lohfeld is the chief executive officer of Lohfeld Consulting Group. E-mail your comments to RLohfeld@LohfeldConsulting.com.

This article was originally published January 5, 2012 in WashingtonTechnology.com.

Paperback or Kindle

10 steps to creating high-scoring proposals

by Bob Lohfeld

contributors Edited by Beth Wingate

Subscribe to our free ebrief

Teaming friends, frenemies, and enemies—12 tips to mitigate harmful effects

Did you know that contracting officers spend up to 20% of their time mitigating disputes between teaming partners? In an informal poll we conducted on LinkedIn last month, 40% of respondents classified their teaming partners as “frenemies” on their last bid.

Explore Further

- Advice (445)

- AI (5)

- APMP (17)

- Business Development (197)

- Capture Management (196)

- Favorite Books (5)

- Go-to-Market (27)

- Graphics (6)

- Lohfeld Books (3)

- Past Performance (58)

- Post-submission Phase (15)

- Pre-RFP Preparation (210)

- Proposal Management (269)

- Proposal Production (60)

- Proposal Reviews (27)

- Proposal Writing (77)

- Pursuit Phase (89)

- Research Report (2)

- Resources (60)

- Tools & Tips (258)

- Training (10)

- Uncategorized (220)

Sign Up for INSIGHTS and Download your FREE book

We'd love to help you with your proposals. Enjoy our complimentary Lohfeld Consulting Group Capture & Proposal Insights & Tips book with your FREE subscription to our Insights Newsletter.

GET YOUR FREE BOOK