How well did government contractors do in 2013?

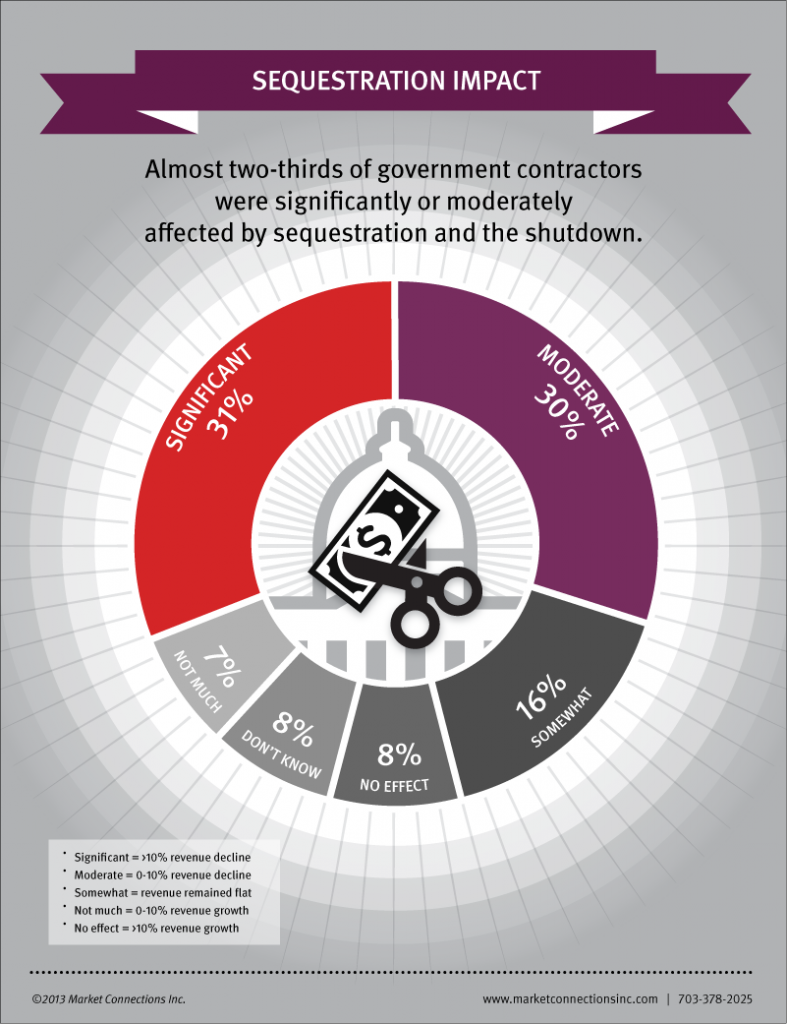

Before this year fades from memory, I thought it would be instructive to take a look back at 2013 and examine how well, or not well, government contractors did in terms of revenue growth. You will recall that this past year, companies had to endure almost all the downside trauma that government can throw at them—budget delays, budget cuts, sequestration, a shutdown, and non-stop uncertainty. All of these actions caused procurements to slip to the right, and in some instances, be cancelled. Because of this turmoil, only 15 percent of government contractors made it through the year with an uptick in sales, and the rest found their sales flat or declining rapidly.

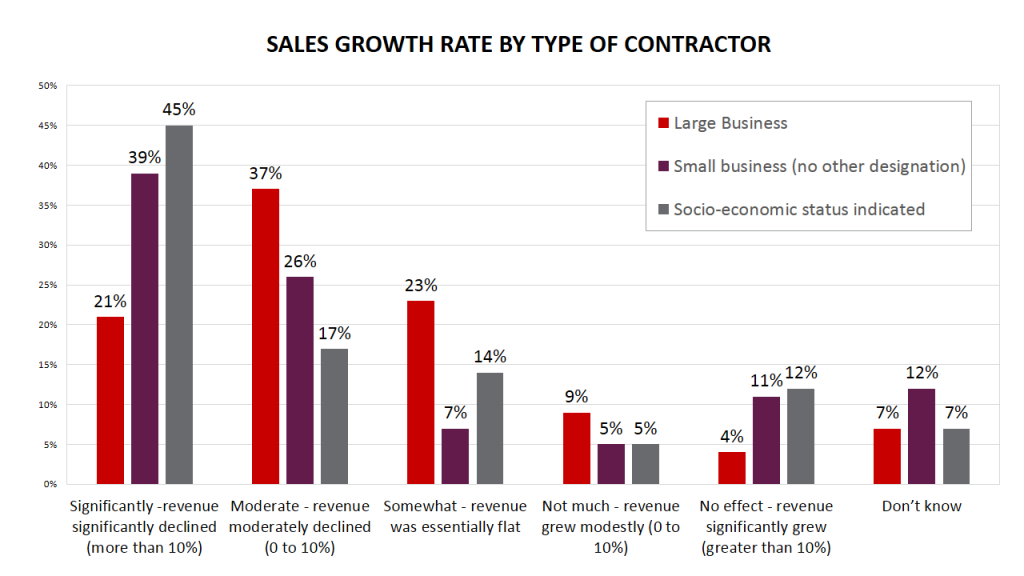

To get a handle on the details, we joined with Market Connections, a market research firm, and jointly polled 220 government contractors to learn how their sales turned out in calendar year 2013. We asked respondents to tell us if their company’s sales increased significantly (which we defined as greater than 10%), increased moderately (less than 10%), were flat (essentially 0%), declined moderately (declined not more than 10%), or declined significantly (more than 10%). Figure 1 illustrates the survey results.

Figure 1. 2013 sales growth rate by type of government contractor.

Positive sales growth

If your firm’s revenue grew at all in 2013, you should feel pretty good because you were the exception in the market. What really surprised us was that only 15 percent of all companies surveyed reported positive sales growth in 2013, and smaller companies tended to have more significant growth than the larger firms (see Figure 2).

On average, 8 percent of the companies surveyed had sales growth greater than 10 percent (significant revenue growth), so if your company’s sales increased by 10 percent or more, you are in the top 8% of the class.

Figure 2. Sequestration impact on government contractors.

Using survey data, we were able to break this growth statistics down further based on company size and type of company and saw that a greater percentage of small businesses achieved significant sales growth compared to larger businesses. Fewer large businesses (only 4 percent) achieved sales growth greater than 10 percent, whereas about 12 percent of small businesses achieved sales growth greater than 10 percent. It didn’t seem to matter whether the small businesses participated in socioeconomic preferences programs (8(a), Service Disabled Veteran Owned Small Business (SDVOSB), Woman Owned Small Business (WOSB) and Historically Underutilized Business (HUB) Zone) or not since both groups had about 12 percent of their firms achieve sales growth greater than 10 percent. Anyway you cut it, seeing revenue growth above 10 percent was a rare occurrence.

While small businesses trumped large businesses in terms of significant growth, the situation reversed itself when we looked at companies that had moderate sales growth (less than 10 percent revenue growth). On average, only 7 percent of companies surveyed had moderate sales growth. Large businesses led in this category with 9 percent of large businesses recording moderate sales growth while small businesses lagged behind with 5 percent achieving moderate sales growth. Again, sales growth was independent of whether the small businesses participated in socioeconomic preference programs or not.

Flat or declining sales

A whopping 77 percent of companies surveyed said they had flat or declining sales. Eight percent of the survey respondents did not comment on their companies’ sales, so this number could actually be higher. Because of the non-responders, I would be comfortable rounding this up to 80 percent and would say that four out of five government contractors saw flat or declining revenue in 2013.

Flat sales were reported by 23 percent of the large businesses, whereas only 8 percent of small businesses were able to hold their own with sales flat. Large businesses seemed to have a better defensive strategy—perhaps because they tend to perform contracts that are larger and more resistant to change than those contacts performed by smaller companies. In any case, large businesses held up better with a more defensive stance than small businesses.

Declining revenue was the norm in 2013 with 61 percent of companies surveyed reporting moderate to significant sales declines. Sales of large businesses declined less than small businesses, demonstrating that large businesses were more resilient to Washington’s continual trauma than small businesses. While only 21 percent of the large businesses had revenue loss of 10 percent or more, 39 percent of small businesses without socioeconomic preferences and 45 percent of small businesses with socioeconomic preferences saw declines of 10 percent or more. In effect, sequestration and the government shutdown absolutely hammered small businesses.

Wrapping it up with a bow

Personally, I’m glad to see 2013 coming to a close, and I remain optimistic about 2014. It looks like Congress will pass a budget, and the president will undoubtedly sign it into law. This greatly reduces the uncertainty in the market, and there is even encouraging discussion that some of the sequestration cuts may be restored. Given this, let’s wrap up 2013 with a bow and get your game on for 2014!

By Bob Lohfeld

Paperback or Kindle

10 steps to creating high-scoring proposals

by Bob Lohfeld

contributors Edited by Beth Wingate

Subscribe to our free ebrief

Teaming friends, frenemies, and enemies—12 tips to mitigate harmful effects

Did you know that contracting officers spend up to 20% of their time mitigating disputes between teaming partners? In an informal poll we conducted on LinkedIn last month, 40% of respondents classified their teaming partners as “frenemies” on their last bid.

Explore Further

- Advice (446)

- AI (5)

- APMP (17)

- Business Development (198)

- Capture Management (197)

- Favorite Books (5)

- Go-to-Market (27)

- Graphics (6)

- Lohfeld Books (3)

- Past Performance (58)

- Post-submission Phase (15)

- Pre-RFP Preparation (211)

- Proposal Management (270)

- Proposal Production (60)

- Proposal Reviews (27)

- Proposal Writing (77)

- Pursuit Phase (89)

- Research Report (2)

- Resources (60)

- Tools & Tips (259)

- Training (10)

- Uncategorized (220)

Sign Up for INSIGHTS and Download your FREE book

We'd love to help you with your proposals. Enjoy our complimentary Lohfeld Consulting Group Capture & Proposal Insights & Tips book with your FREE subscription to our Insights Newsletter.

GET YOUR FREE BOOK